Dow Jones Futures Chart Dow 30 Futures Quotes

Benefit from risk mitigation through CME Clearing, one of the world’s leading central counterparty clearing systems that backs all transactions in our markets. CME E-mini Dow $5 Futures and Options, ticker symbol YM, represent one of the most efficient and cost-effective ways to gain market exposure to the Dow Jones Industrial Average. Enjoy greater choice and flexibility for trading E-mini S&P futures and options https://investmentsanalysis.info/ with more expiries and new enhancements, including the introduction of ES options blocks. Enjoy potential margin offsets against other benchmark equity index futures. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Stock market news live updates: Dow gains 220 points, or 0.6% to reach a record close amid optimism over contained inflation, infrastructure – Yahoo Finance

Stock market news live updates: Dow gains 220 points, or 0.6% to reach a record close amid optimism over contained inflation, infrastructure.

Posted: Wed, 11 Aug 2021 07:00:00 GMT [source]

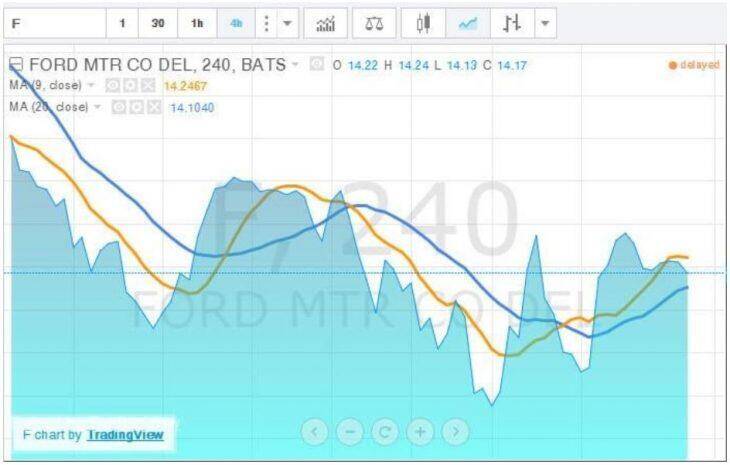

The E-mini Dow (YM) is a financial futures instrument which enables traders to speculate on the future value of the Dow Jones Industrial Average. At Schwab, you also get access to advanced trading platforms and education, where you can take advantage of market research, real-time Mini Dow futures quotes, and other specialized tools. Tick sizes are defined by the exchange and vary depending on the size of the financial instrument and requirements of the marketplace. Tick sizes are set to provide optimal liquidity and tight bid-ask spreads. The tick size of the NYMEX WTI Crude Oil contract is equal to 1 cent and the WTI contract size is 1,000 barrels. If you’re new to futures, the courses below can help you quickly understand the E-mini Dow market and start trading.

$0 online listed equity trade commissions + Satisfaction Guarantee.

Tick sizes are set by the exchange and vary by contract instrument. Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading.

Other CME Group e-mini futures include contracts based on the Nasdaq-100 Index (NDX), Dow Jones Industrial Average ($DJI), and the Russell 2000 Index (RUT). Futures contracts expire quarterly, with a contract size of five times the DJIA, and a minimum tick value of $5. The E-mini Dow $5 futures contract allows you to gain exposure to all 30 Dow-listed companies by trading a single contract. An electronically traded futures contract representing a portion of standard DJIA futures, E-mini Dow futures offer an accessible alternative to manage exposure to the U.S. stock market. Based on the Dow Jones Industrial Average, E-mini Dow futures offer exposure to the 30 U.S. blue-chip companies represented in the stock index. Please read the Risk Disclosure Statement prior to trading futures products.

YM00 Overview

Not investment advice, or a recommendation of any security, strategy, or account type. Residents, Charles Schwab Euro vs.Dollar history Hong Kong clients, Charles Schwab U.K. Learn more about futures and the unique advantages of futures trading.

The minimum tick is one-quarter of an index point, or $12.50 per contract. Mini Dow futures represent a portion of the standard Dow Jones Industrial Average (DJIA) futures. The DJIA is the world’s most widely followed stock index and the leading U.S. stock market benchmark. The high trading volumes and the leverage available have made Mini Dow futures and Micro E-mini Dow futures popular ways to trade the overall U.S. stock market. TD Ameritrade offers access to a broad array of futures trading tools and resources. Access more than 70 futures products nearly 24 hours a day, six days a week through Charles Schwab Futures and Forex LLC.

December gold settles at $1,952.60/oz on Comex, down $14.50, or 0.7%

For Micro E-mini S&P 500 futures, the minimum tick or price fluctuation is also 0.25 index point, or $1.25 per contract (one-tenth of the $12.50 per contract of the /ES). The value of one contract is calculated by multiplying the current level of the index by $5. Information on commodities is courtesy of the CRB Yearbook, the single most comprehensive source of commodity and futures market information available.

- Past performance is not necessarily indicative of future results.

- The E-mini Dow $5 futures contract allows you to gain exposure to all 30 Dow-listed companies by trading a single contract.

- Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

- E-mini Dow futures allow you to hedge your macro exposure or capitalize on anticipated movement in the DJIA Index, especially around major market-moving events.

- Its sources – reports from governments, private industries, and trade and industrial associations – are authoritative, and its historical scope for commodities information is second to none.

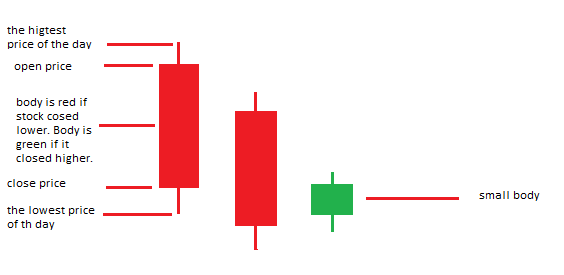

Futures contracts have a minimum price fluctuation, also known as a “tick”. Tick sizes are among the “contract specifications” set by futures exchanges, such as the Chicago-based CME Group, and are calibrated to encourage efficient, liquid markets through “tight” bid/ask spreads. They vary depending on the type of contract, size of financial instrument, and requirements of the marketplace. Tick sizes and values are also different for CME Group’s Micro E-mini equity index futures (/MES), which the exchange launched in May 2019 and are one-tenth the size of CME Group’s e-mini equity index futures contracts. For beginner futures traders who just want to “test the waters,” micros mean risking less money by trading a slice of the equity index e-mini products.

How Tick Sizes and Values Vary in Index Futures

They help us track how much prices go up or down on a given day, revealing how much money we made or lost. Here’s an example of how tick sizes are a different sort of animal versus stocks. Say, you hold 100 shares of a stock trading at $10 per share, with a total position value of $1,000. In this case, an increase or decrease of $0.10 calculates out to $0.10 x 100, or a gain or loss of $10. For stocks, tick sizes are fairly straightforward—basically, it’s dollars and cents times the number of shares.

- Options trading subject to TD Ameritrade review and approval.

- Compared to traditional investments, with Mini Dow futures you can trade nearly 24 hours a day during the trading week and take advantage of trading opportunities regardless of market direction.

- Enjoy added flexibility and efficiency with the ability to execute a basis trade relative to the official close.

- They vary depending on the type of contract, size of financial instrument, and requirements of the marketplace.

- Only risk capital should be used for trading and only those with sufficient risk capital should consider trading.

Gain exposure to 30 of the largest companies in the U.S. while trading a single contract with our E-mini Dow ($5) products. Representing a portion of the standard Dow Jones Industrial Average futures, these E-mini products allow you to short the index without stock loans or variable fees. Enjoy added flexibility and efficiency with the ability to execute a basis trade relative to the official close. YM Futures offer investors both long and short opportunities to trade the DJIA in a more cost-effective way than Dow-based ETFs. Equity index futures such as the YM empower traders to access the strength of a total stock index without having positions in each individual stock, making them advantageous instruments to trade.

Capitalize on actively traded markets with consistently tight bid/ask spreads and dedicated market makers providing two-sided markets. When it comes to well-known benchmarks of the US Economy, the Dow Jones Industrial Average, otherwise referred to as “the Dow,” comes to mind. As the world’s most closely followed stock index, the Dow Jones Industrial Average is comprised of the 30 biggest and most dominant companies in the US. The Futures Contract Specifications page provides a complete look at contract specs, as provided by the exchanges. Specifications are grouped by market category (Currencies, Energies, Financials, Grains, Indices, Meats, Metals and Softs). All symbols and information are based on research and is not guaranteed to be accurate.

Mini Dow futures provide investors and traders with an efficient way to gain speculative exposure to the U.S. stock market, or they may be used to hedge stock portfolios against overall market risk. Mini Dow futures may also be spread against other popular stock index futures. CME Group is the world’s leading derivatives marketplace. The company is comprised of four Designated Contract Markets (DCMs). Further information on each exchange’s rules and product listings can be found by clicking on the links to CME, CBOT, NYMEX and COMEX.