How to Trade Chart Patterns with Target and SL

Contents:

For this reason, candlestick patterns are a useful tool for gauging price movements on all time frames. While there are many candlestick patterns, there is one which is particularly useful in forex trading. The head and shoulders pattern is one of the most common patterns on forex markets. As the name suggests, a head and shoulder pattern resembles human anatomy. If you spot a triangle pattern on your chart, the general advice is to wait until the price breaks out and forms a new trend. When it happens, you can enter a trade at the breakout point and move in the direction in which the price is moving.

The chart patterns start emerging when a sharp local trend ends; the movements start slowing down and there occurs a sharp surge in volume in a thin market. First, buyer or seller, who was trying to break the flat, can just remove the volume from the market and the price will go back. Second, a bigger trade volume in the opposite direction is put against the volume of the first trader and returns the price to the former levels. You enter a sell trade when the price, having passed down through the pattern support line, reaches or breaks through the local low, followed by the support breakout .

Double top

Forex Chart Patterns are used for technical analysis to predict the future movement of the market. After a breakout, the distance of the first wave inside the Triangle should be your minimum take profit target. Descending Triangle is formed during the downtrend or retracement in an Uptrend. Ascending Triangle is formed during the Uptrend or retracement in a downtrend. If you saw a double bottom in the chart, wait for the confirmation of breakout at the recent high level. If you saw a double top in the chart, wait for the confirmation of breakout at the recent low level.

We’re also a community of https://traderoom.info/rs that support each other on our daily trading journey. The only problem is that you could catch a false break if you set your entry orders too close to the top or bottom of the formation. To trade these patterns, simply place an order above or below the formation . For instance, if you see a double bottom, place a long order at the top of the formation’s neckline and go for a target that’s just as high as the distance from the bottoms to the neckline.

In an uptrend a down candle real body will completely engulf the prior up candle real body . Triangles occur when prices converge with the highs and lows narrowing into a tighter and tighter price area. They can be symmetric, ascending or descending, though for trading purposes there is minimal difference. The H&S pattern can be a topping formation after an uptrend, or a bottoming formation after a downtrend.

Forex Chart Patterns You Need to Use in 2023

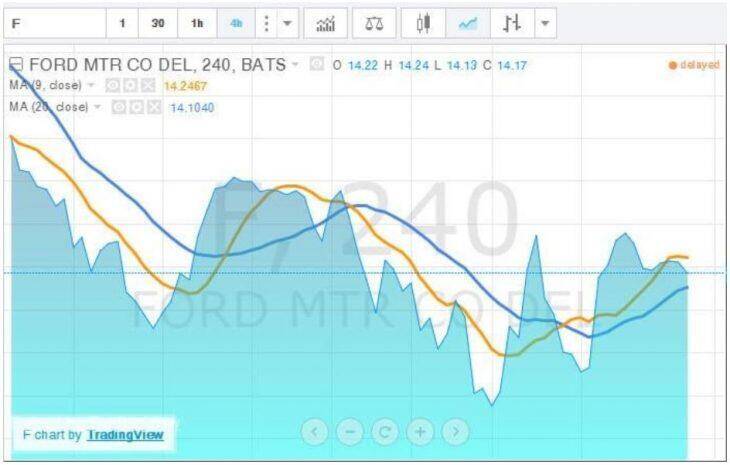

Learning how to analyze a forex chart is a critical skill for anyone interested in trading forex markets successfully. The process of analyzing the chart begins with choosing the proper time frame. If you want to day trade you’ll choose a shorter time frame, perhaps one hour or less, but for momentum trades a longer time frame such as daily works best. You can also analyze the weekly chart to get a long-term picture of the market. Once you have the proper time frame your analysis is a matter of looking for emerging trends and technical patterns, as well as support and resistance levels. Continuation chart patterns form during an on-going trend and they signal that the dominant trend will continue.

Get real-time actionable trade ideas on dozens of popular markets based on historic price action patterns. Traders will often use the height of the pattern at its outset to give an idea of the size of the following trend. If our bull flag has 50 points between its support and resistance lines, then we might set our take profit 50 points above resistance. Symmetrical triangle patterns occur when two trend lines approach one another. Essentially, it’s like if you overlaid an ascending triangle onto a descending one – and got rid of both of the horizontal lines.

Forex Trading Technical Analysis got easier using the forex chart patterns. Trading chart patterns are easier to identify the future price movement. Whether it is continuation patterns or reversal patterns or neutral forex chart patterns, all types of forex trading chart patterns comes under the price action trading journey. Chart patterns are a great price action technique, and the signals they provide can be more qualified by candlestick patterns that also help in analysing the raw price movement of the market. A chart pattern will be more qualified if there is a confluence with candlestick patterns, such as pin bars, Marubozu, spinning tops and Doji. There are multiple trading methods all using patterns in price to find entries and stop levels.

Most Popular Forex Chart Patterns

Flags are among the most popular Forex chart patterns and they are exclusively trend-continuation patterns. The longer the previous trend the higher the chances of seeing a powerful reversal. The longer the bearish trend has been going on, the fewer new sellers are left in the market. Also, more traders are sitting on a significant amount of unrealized profits and are ready to exit their trades. Trading patterns act as a visual representation of past market activity and as indicators of future price movement.

It allows traders to place stop-loss orders and minimise potential losses. When you are just getting started with the Head and Shoulders pattern I would recommend focusing on horizontal breakout patterns first. SMART Signals scan the markets for opportunities so you don’t have to.

Forex trends and patterns before the US CPI release – FXStreet

Forex trends and patterns before the US CPI release.

Posted: Tue, 11 Apr 2023 11:20:57 GMT [source]

This is another reason why I love having this price structure included in my trading plan. Unlike the head and shoulders we just discussed, the wedge is most often viewed as a continuation pattern. This means that once broken, price tends to move in the direction of the preceding trend. What you can do in this case is to place entry orders just above the resistance line and below the support line. This way, you will automatically enter the trade without worrying about the direction in which the market moves next. Or alternatively, you can wait for the breakout to see where the price ends up moving and then go with the flow.

Go to our Trading Academy

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. While a pennant may seem similar to a wedge pattern or a triangle pattern – explained in the next sections – it is important to note that wedges are narrower than pennants or triangles. Also, wedges differ from pennants because a wedge is always ascending or descending, while a pennant is always horizontal.

EUR/USD Bounce Facing Strong Resistance at the 1.08 Level Ahead of FOMC – DailyFX

EUR/USD Bounce Facing Strong Resistance at the 1.08 Level Ahead of FOMC.

Posted: Wed, 22 Mar 2023 07:00:00 GMT [source]

Ascending triangles can also indicate the start of a downtrend if price breaks lower or volume declines. Ascending and descending staircases are probably the most basic chart patterns. But they’re still important to know if you’re interested in identifying and trading trends.

2-3 Pattern: candlestick model trading

A stop loss may be set at little higher than the local highs of the sideways corrective movement . In this case, you can simply trade with pending orders, or be careful to check that the pattern’s support and resistance lines are parallel to each other. The ascending or descending Triangle pattern is very important in the Elliott wave analysis.

The perfect chart formation is visible only if you keep drawing the trendlines, horizontal support and resistance levels. The cup and handle chart pattern is used to identify the price points to go long or enter the market. It shows a bearish market movement which soon converts into a bullish trend.

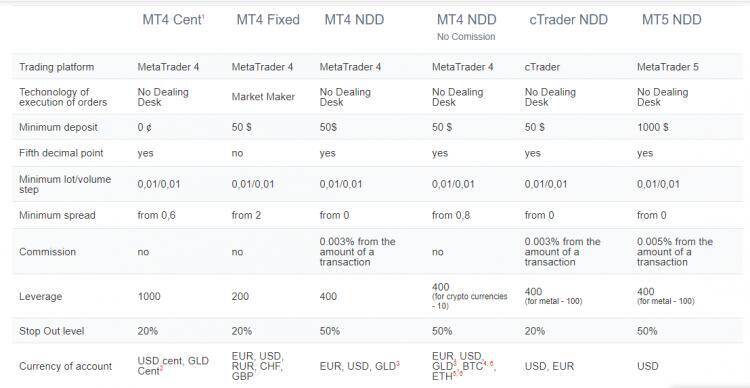

- Conditional orders have defined price targets and they help traders manage risks, open positions, as well as secure profits.

- They are stop loss hunters due to high spread even in major currency pair like EUR USD, USDJPY, GBPUSD.

- The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following.

- Technical analysts have long used chart patterns as a method for forecasting price movements and trend reversals.

- The longer the previous trend the higher the chances of seeing a powerful reversal.

- Of retail investor accounts lose money when trading CFDs with this provider.

forex chart patternsrs are then waiting for pullbacks to identify entry opportunities. The next trend wave, moving from point 2 to point 3 is forming a lower high and the price is not coming close to the previous highest high at point 1. The selling wave from points 1 to 2 is the strongest bearish wave that we have seen during the entire uptrend.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Falling wedges, on the other hand, are bullish patterns that generally precede uptrends. As price consolidation trends downward, a financial instrument reaches several lower highs and lower lows before ultimately breaking out above the trend line. Symmetrical triangles usually occur in markets that don’t move in one direction.

In the following parts, I’ll dwell upon the most common Forex Japanese candlestick patterns and some original configurations. The descending triangle is a chart pattern used in technical analysis. The pattern usually forms at the end of a downtrend but can also occur as a consolidation in an uptrend. The hammer is a useful, single candlestick pattern that can be used to identify a “bottom” in price action for a currency pair. The long wick at the bottom of this price can be indicative of an impending upswing in price, which some traders may use to open a position ahead of the action.

There are different types of chart patterns available – some depict trend reversal points, signalling you to enter or exit the market immediately, while some help identifies market trends. In this article, we will look behind the most commonly traded chart patterns to gain an understanding of what is really going on behind the scenes. A deep understanding of chart patterns allows traders to apply their knowledge to all kinds of chart situations and, therefore, improve their understanding of price action in general. The 9 Forex chart patterns discussed in this article are both trend-following and also trend-reversal patterns.

A guide to price action trading – FOREX.com

A guide to price action trading.

Posted: Mon, 03 Apr 2023 12:45:31 GMT [source]

Often, the butterfly pattern also looks like M in a bullish market and W in a bearish market, signalling multiple trend reversals. Overall, the advantages of chart patterns far outweigh their disadvantages. If well understood, chart patterns have the potential of generating a steady stream of lucrative trading opportunities in any market, at any given time. At AvaTrade, you can use a demo account in order to learn how to recognise chart patterns, without putting any of your trading capital at risk. Timing is an important aspect when it comes to trading chart patterns. This is why conditional orders, such as stop orders and limit orders, provide the best way to take advantage of trading opportunities created by chart patterns.